Visa, Bill.com, Globant, Sea Limited, EPAM all Looking Good Right Now.

Many stocks got very cheap towards the end of November with uncertainty caused by the new Covid variant, higher inflation and a more hawkish comments from Fed Chairman Jay Powell.

Because of this we might have seen a bottom in stocks this week and saw the Market Rocket as a result, with the Nasdaq closing up 3% today.

Let’s dive into some stocks we believe have gotten pretty cheap over the last few days:

- Visa

- EPAM Systems

- Sea Limited

- Bill.com

- Globant

- Visa – First lets take a deep dive into Visa. Risk Grading: Low, Return Rating: Medium

Visa has been one of the better stocks on the market over the last 12 years. Giving a positive year over year return every year but this year and 2010, as well as making new all time highs every single year. With that said, 2021 has been a bad year for Visa, which is why we think now is actually a good opportunity to give the stock a look.

Visa is on a 4 month losing streak giving negative Month over Month returns in August, September, October and November. Its longest monthly losing streak ever going back to 2009. All streaks whether winning or losing eventually come to an end. We believe for this reason once Visa gets out of its slump it will bounce back in 2022. Inflation actually helps Visa as its fees make more money off of rising prices.

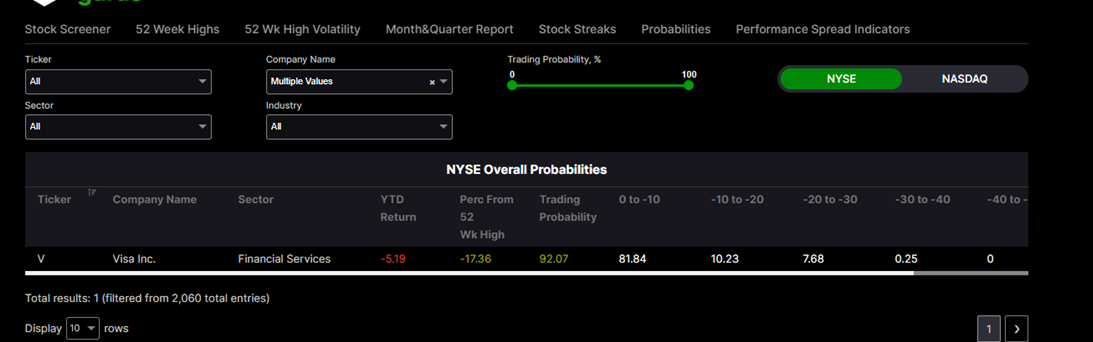

Visa is currently down 17% from its all time high. Which means most of the downside risk in this stock is already priced in with a 8% chance of going lower than this. If we are right about this and the trends the past is the best predictor of future performance then Visa could be setting up for a nice rebound. See the charts below:

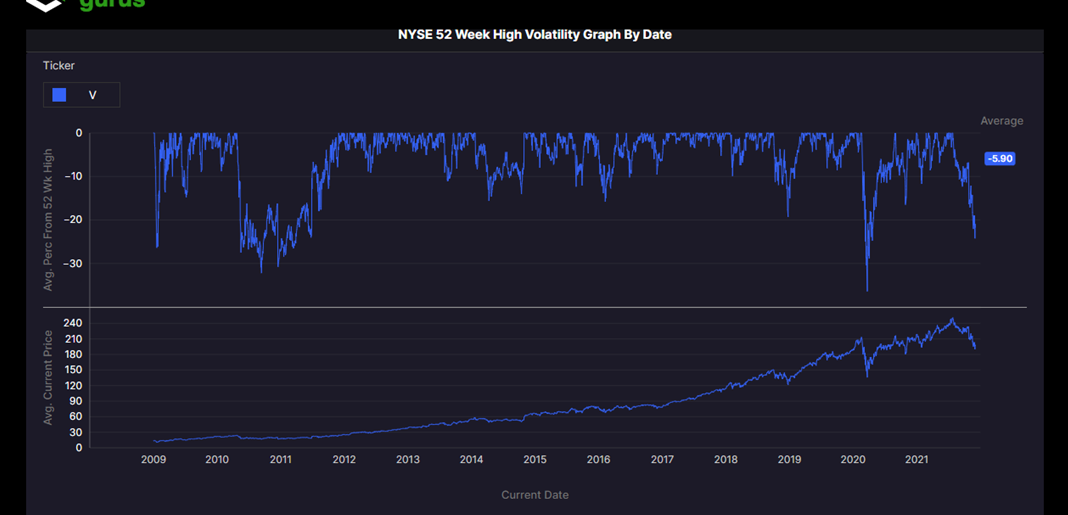

Visa on average trades about 6% from its all time highs and as of right now it is down 17% from its all time highs:

2. EPAM Systems – Risk Grading: Medium Low Return Grading: High

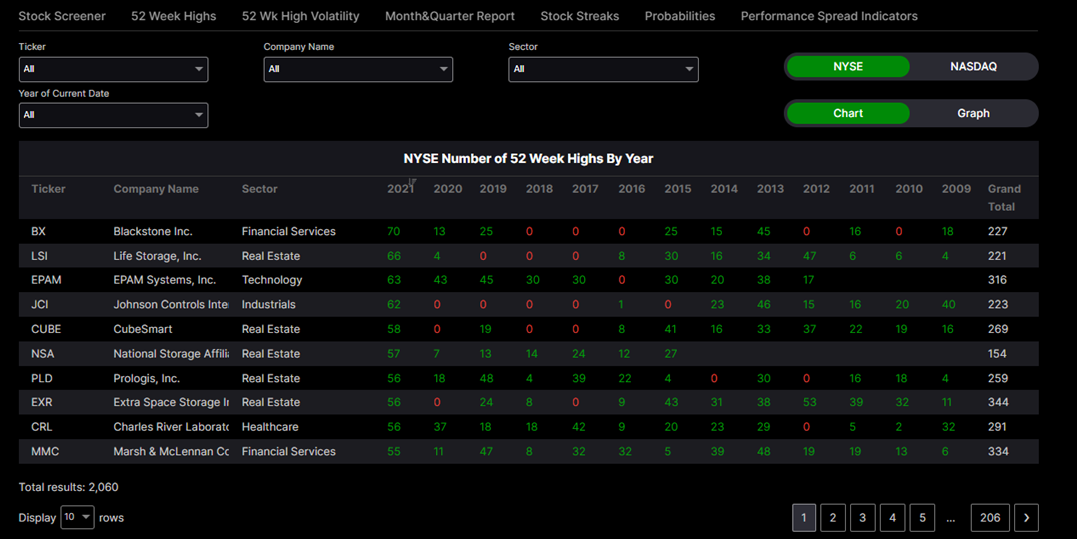

EPAM Systems has been one of the best stocks on the market going back to its inception. It has given a positive return in 8 of its last 9 years with those returns averaging 52%. It is constantly one of the leaders in producing new all time highs year after year, current it has made 63 all time highs this year placing it 3rd out of the 2,000 stocks on the NYSE.

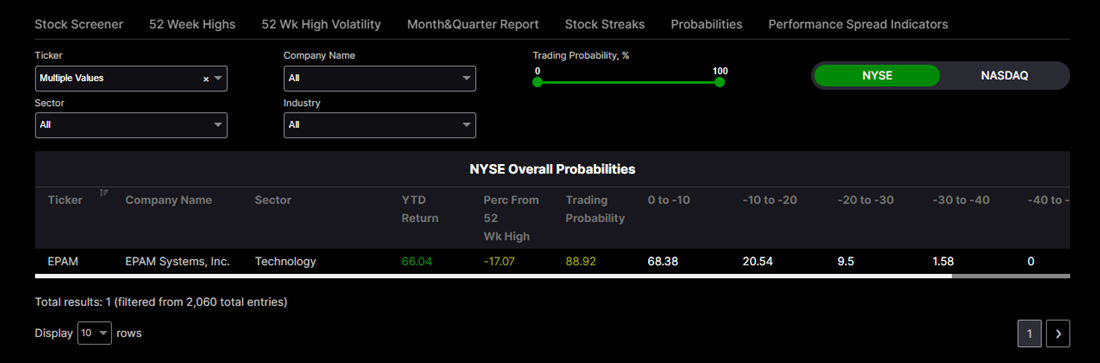

As it stands right now EPAM Systems is up 66% year to date but is currently trading about 17% from its all time highs. This means most of the down side risk is priced in. In an extreme case we could see this falling another 13% down to around the 30% range from all time highs but we would put about a 13% probability of that happening based on the data below:

EPAM on average trades down about 8% from its all time highs which is currently outside of its averages.

Be Patient with EPAM December is typically the worst month for EPAM Systems historically. But it tends to have a nice recovery come January:

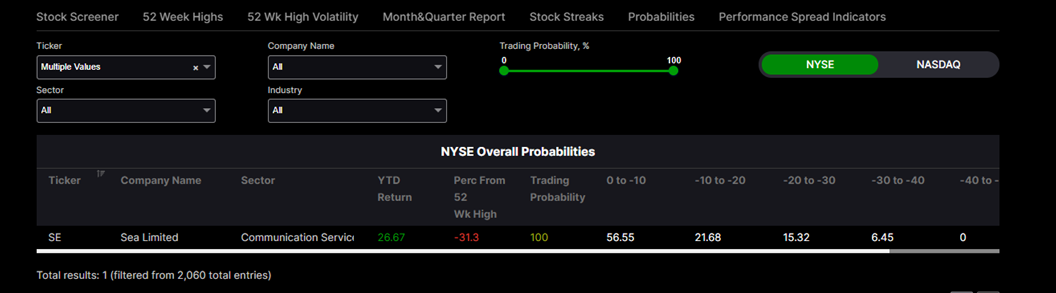

3. Sea Limited. Risk Grading: High Risk, Return Grading: Very High

Sea Limited has been an absolute beast averaging triple digit returns in 2019 and 2020. Sea Limited has a very unique business. It is a big player in the gaming industry as well as E-Commerce in Singapore. From PC Games, to Online Games to E-Sports and many other items. Currently Sea Limited is up only 27% YTD.

Sea is currently down 31% from its all time highs. And we believe most of the downside risk is priced into this stock and it could be way oversold. Which is why we think this high flyer could be at a great entry point.

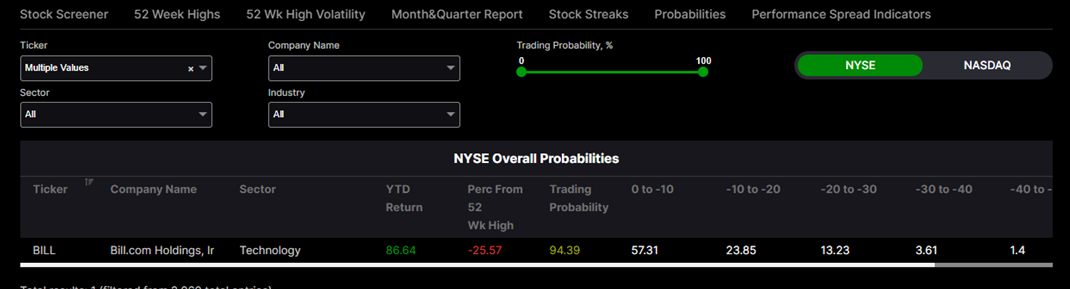

4. Bill.com – Risk Grading: Very High, Return Grading: Very High.

We rated Bill.com as a very high risk stock simply due to its lack of historical data, (only 2 years worthy). With that said Bill.com has absolutely crushed it since going public. It was up 259% in 2020 and likewise is up 87% year to date this year.

Bill.com is currently down about 25% from its all time highs. We believe this could just be a normal pullback. According to our data it looks like Bill.com could go lower but the probability is vey low but not impossible, but tread lightly due to the lack of data.

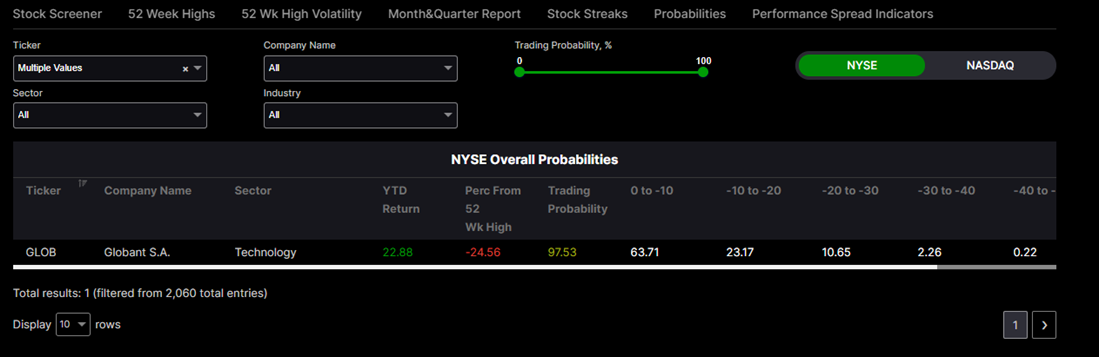

5. Globant – Risk Grading: Medium, Return Grading: Medium

Globant is an interesting stock that many people most likely have never heard of. With the world going more and more digital companies are becoming more dependent on software development and IT Consulting firms. Especially companies in the Internet of Things, Cybersecurity, data analytics, and artificial intelligence this is where Globant comes in handy.

Globant S.A. has made a positive return every year but 2016 and has averaged a 58% return over the last 7 years. It is currently down 25% from all time highs and we believe based on the data that most of the negative is already priced in. There is about a 2% chance it falls in the 30-40% range from its all time highs.

Disclaimer:

Risk Disclosure: Trading in financial instruments involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Trading on margin increases the financial risks.

Before deciding to trade stocks you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.