The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

tggvgvvjnbbnbnj njn

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

All data and analysis provided here are for information only. All data and analysis contained herein are provided without warranty or guarantee of any kind, either expressed or implied. Using this data and analysis could incur substantial financial losses. The provider of this data and analysis shall not have any liability for any loss sustained by anyone who has relied on the data and analysis contained herein. The provider of this data and analysis makes no representation

or warranty that the information contained herein is accurate, fair, or correct or that any transaction is appropriate for any person and it should not be relied on as such.

Top Picks

Red Hot Inflation. Rate Hikes. What stocks are on watch through all this?

November is a Great Month for Markets. AAON, ROKU, TRUP on Watch this Week

Stock Screener Tutorial

Stock Screener Tutorial

The Stock Screener shows you Year over Year Returns of all stocks on the NYSE and Nasdaq Going back to 2010.

In this report you will find columns such as Total Positive Returns, Number of Years, Positive Return Rate and Average Percent Difference.

This report will help you drill down by these columns. For example if you want find stocks that have given the highest average year over year return going back to 2010. You can accomplish this by Sorting by Average Perc Difference. It is important to note this Percent Difference includes both Positive and Negative Returns. You can also filter this by year end date to take out negative years or take out positive years to see how bad a stock does if you are expecting the market to have a bad year.

This report also has a column called Positive Return Rate. How this calculation works is it looks at a stocks number of total positive returns (in the numerator) over the total number of years trading going back to 2010. So if a stock has been trading for 10 years on the market and 9 of those years it gave a positive return. The Positive Return Rate would be 90% or (9 Positive Returns/10 Total Years) = 90%. This would be a pretty good stock to invest in based on its high level of predictability.

Stock Screener Report

52 Week high Year Over Year Percent Return Report

52 Week high Year Over Year Percent Return Report Tutorial

52 Week High Year Over Year Percent Return Report Tutorial:

This report shows you a graphical representation of a stocks Year Over Year Percent Return Represented by the Blue line and the Number of 52 Week Highs made by a stock represented by the orange bars by year. See the screen below:

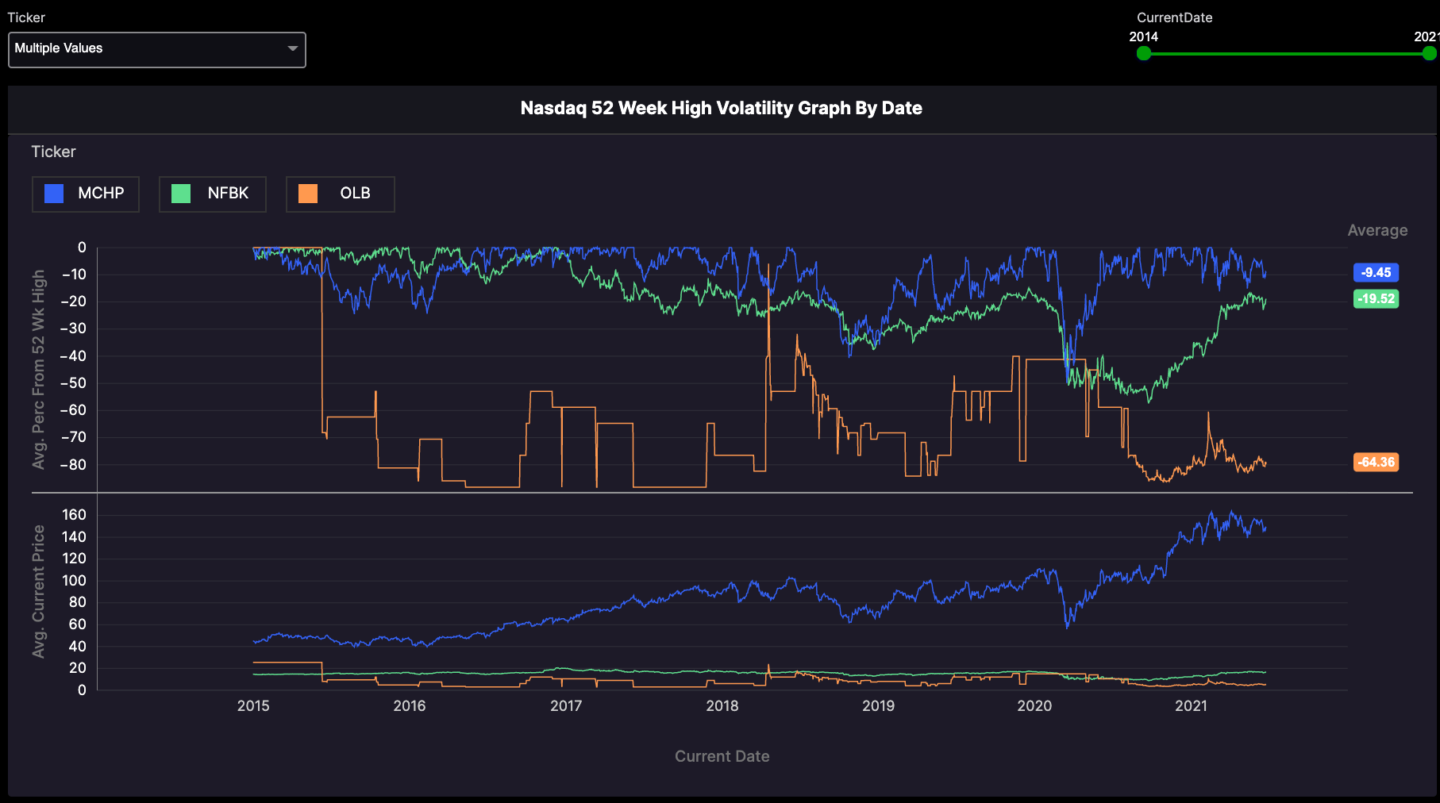

Volatility Report tutorial

Volatility Report:

This report looks at the volatility of stock. It looks like at how far a stock is from its 52 week high historically. Each time a stock hits 0 means it made a new 52 week high or it is 0% from its 52 week high. This report can show you many things such as the average percent a stock trades from its 52 week high. You can also compare more than one stock to get a gauge of what stocks will drop more or less during a sell off. See the screenshot below.

You can see in the differences in the screenshot above between Microsoft (blue line) and Tesla (Red Line). This graph tells you a couple things:

- Microsoft is a much more stable stock. You can see it has hit way more 52 week highs than Tesla.

- You can see Tesla is has much more wilder swings.

- Microsoft plays offense and defense and is a stock to own during market downturns.

- You can also get a gauge of time between 52 week highs. You can see Microsoft’s gap is much small than Tesla’s. Meaning in can be years before a stock like Tesla hits another 52 week high where as Microsoft it will typically be less than a year.

You can also get a gauge of the average percent difference a stock trades from a 52 week high. In the case of Microsoft it’s Average percent difference from its 52 week high is about -6.70% this suggest that anything below -7% is a good time to buy a stock like Microsoft. You can see that Microsoft has only fallen more than 25% just a few times since 2009. Suggesting that this is a great defensive play. See the screenshot below:

You can also adjust the date to drill down into this report to see how the volatility changes using the date slider:

Volatility Report

Performance Spread Indicator Report Tutorial

Performance Spread Indicator Report Tutorial

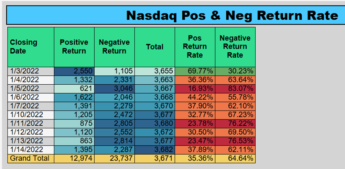

This report shows you the Total Number of Days a stock is traded, the total Number of Negative Days and the Total Number of Positive Days. And then looks at the probability that a stock is up.

Take for example Wingstop (WING). There have been 134 trading days so far in 2021. Of those 134 How this report works is like this:

Let say Shopify closes up 5% and say the Nasdaq closed up 1%, the Dow was down -.5% and the S&P was down -0.25%

To get the performance spread you would take Shopify’s return for that day and subtract it by the daily return of the Dow, S&P and Nasdaq.

This would look something like this:

| Shop Return: | Index Return: | Performance Spread: |

|---|---|---|

| 5% | Nasdaq: 1% | 5% – 1% = 4% |

| 5% | Dow: -0.5% | 5% – – 0.5% = 5.5% |

| 5% | S&P: -0.25% | 5% – – 0.25% = 5.25% |

In this case this is essentially telling you that SHOP outperformed the Dow 5.5%, the S&P500 by 5.25% and the Nasdaq by 4%.

The point of a performance spread indicator is to show you which stocks are outperforming, under performing or in line with the major indices (Dow, Nasdaq, and S&P500). The higher the positive spread the more a stock is beating that specific indices, the lower the negative spread the more it is losing to those specific indices.

Be careful with this report though. It doesn’t tell the full picture. For example outlier events can happen such as a stock going up 50% in a day for some reason which could skew that companies performance spread indicator and make it look like it is crushing the indices but really it had one great day and the rest have been horrible.

To get around this it is best to take those instances out as well as use some of the other reports make your picks. But also you can look at the Positive Performance Spread Probability which does a better job of normalizing the data. I.E. This looks at all positive spreads (when a stock beats the Dow, S&P or Nasdaq) and adds all those up and then divides that by the total number of returns in that year. This show give you a better idea of what stocks to pick. The higher the performance spread as well as the higher the performance spread probability the better the stock.

Performance Spread Indicator Report

Stock Streaks Report Tutorial:

Stock Streaks Report Tutorial:

The Stocks Streaks Report shows you the current streak a stock is on. Whether it is a winning streak or a losing streak.

It also shows you how many days in a row it had its longest winning streak for as well as how many days in a row a stock had its longest losing streak for.

This report also tells you the number of days since a stocks last winning streak or losing streak. I.E. how long it has been since its longest winning streak or losing streak.

Stock Streaks Report

Stock Probability Report

Stock Probability Report Tutorial

Stock Probability Report Tutorial:

This report shows you the Total Number of Days a stock is traded, the total Number of Negative Days and the Total Number of Positive Days. And then looks at the probability that a stock is up.

Take for example Wingstop (WING). There have been 134 trading days so far in 2021. Of those 134 trading days Wingstop has give 57 negative returns and 77 positive returns. For a total number of up days percentage of 57.5% or (77 positive returns / 134 total trading days) = 57.5%. This is telling you that WING is giving more positive returns in 2021 than negative returns 58% of the time. See the screenshot below:

This report also breaks out these return percentages by a hierarch of 1%. So it looks at how many times a stock gave a return between 0 and 1, 5% or more, 2-3% etc. See the screenshot below: