Red Hot Inflation. Rate Hikes. What stocks are on watch through all this?

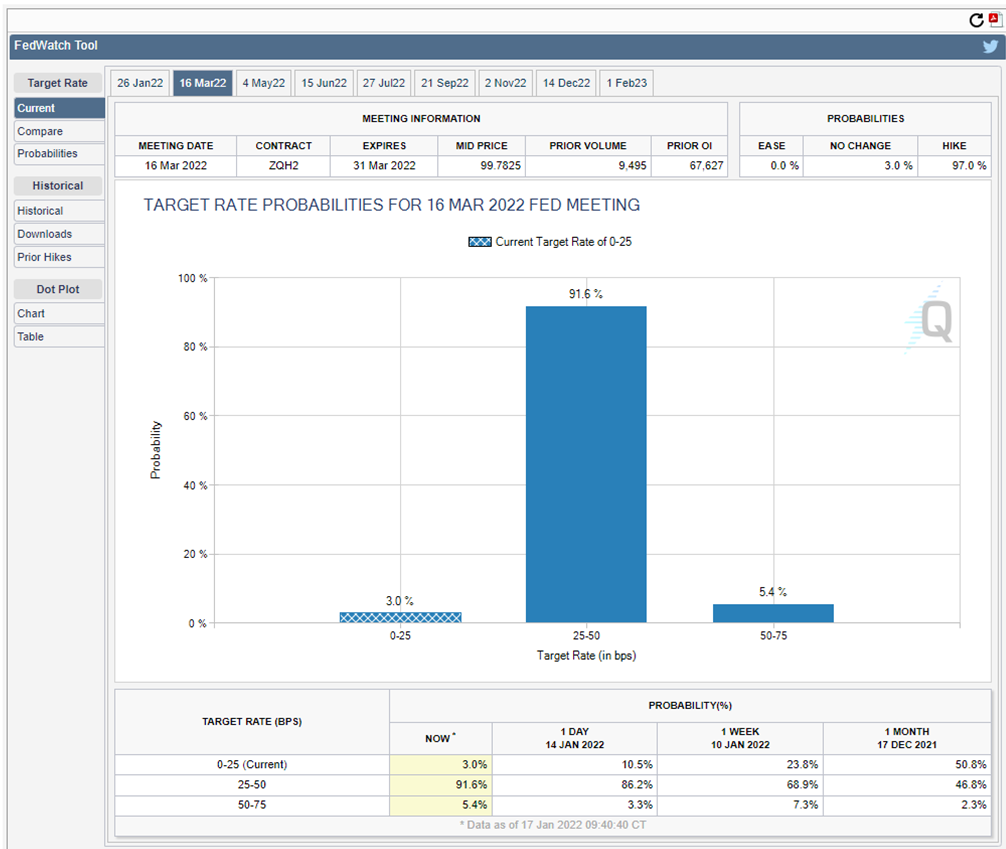

January has been an incredibly rough month for almost all stocks on the market. The only sectors doing somewhat decent are Financials and Energy. The headwinds for the market right now has everything to do with red hot inflation. Inflation had its fastest spike since 1982 reading around 7%. This has caused the fed to get more hawkish in terms of hiking interest rates. The current CME Fed Watch Tool is coming at 92% for a 25 basis point hike in March. The CME fed watch tool is also pricing in about 3 to 4 rate hikes for 2022. There is a lot of uncertainty around rate hikes right now with some people such as Jamie Dimon believing there could be 6 to 7 hikes in 2022. I would pay more attention the CME Fed Watch Tool than Jamie Dimon. See the chart below:

The changes in forecast in the number of hikes has led to a sell off in stocks especially the Nasdaq. As a matter of fact of all the stocks on the market the Nasdaq has been hit the hardest thus far. All indices are negative year to date but the Nasdaq is down about 7% from its all time highs which means it could fall into correction territory soon. The last time the Nasdaq fell into correction territory was March 8th 2021. We believe the market could be due for a correction soon considering it has been well over a year since the Dow and S&P hit correction territory. Corrections are healthy for markets. With that said given the current environment we believe this will lead to good buying opportunities. We also believe more volatility could be ahead too. Right now the the 2 best sectors have been Energy and Financials. This is mainly due to the fact that interest rates are going up which could help banks and rising oil price have pushed energy prices up temporary but we don’t think this will be a long term trend.

As of right now the Nasdaq has only had 1 day in the last 2 weeks in which more stocks gave a positive return than a negative return. And this happened the very first week of the year. With January 5th being the worst day where 83% of all stocks on the Nasdaq finished Negative. There has been a lot of fluff lately about growth vs value and the data in the chart below basically is showing that most stocks have been losing and it doesn’t matter if it is a growth stock or a value stock chances are it is down year to date.

A few stocks that we like that have pulled back significantly to start the year are are:

1. Chipotle (CMG),

2. The Nasdaq (NDAQ),

3. The Pool Corporation (POOL),

4. Intuit (INTU).

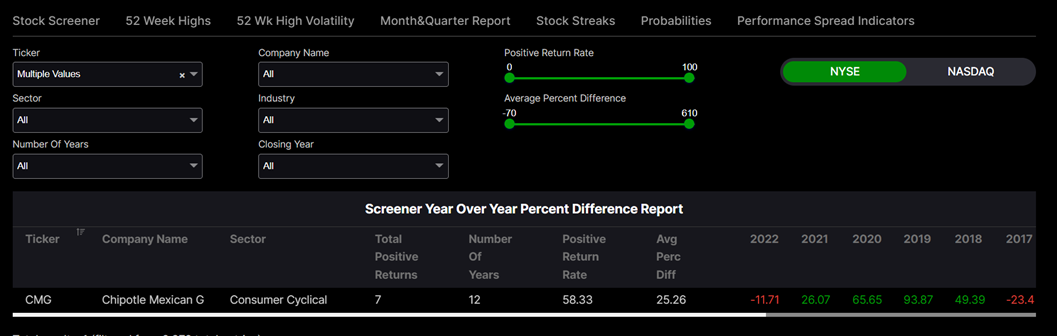

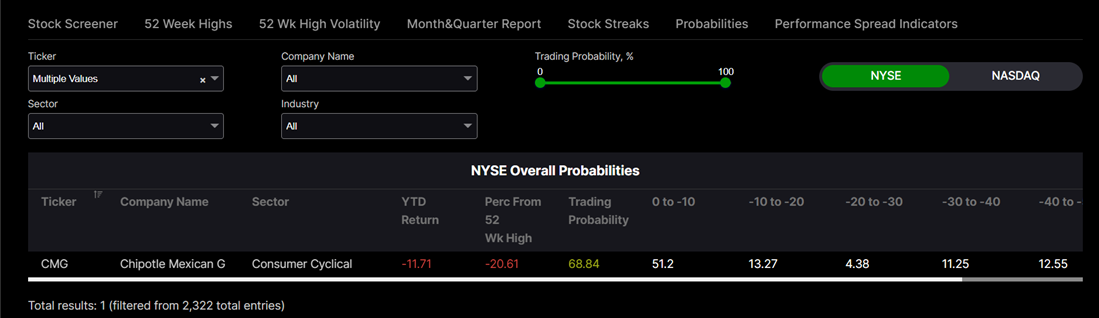

First lets start with Chipotle (CMG). Chipotle is an incredibly well run company. They have solid revenue growth, great free cash flow to revenue and no long term or short term debt on the balance sheet. Chipotle has given a positive return in 4 of the last 4 years if you exclude 2022. It has also made a tremendous comeback from its really bad negative publicly it went through from 2015 to 2017 with its Ecoli outbreaks which shows the stocks resiliency. Right now CMG is down 11.71% year to date, and is down about 21% from its all time highs which puts the stock in bear market territory.

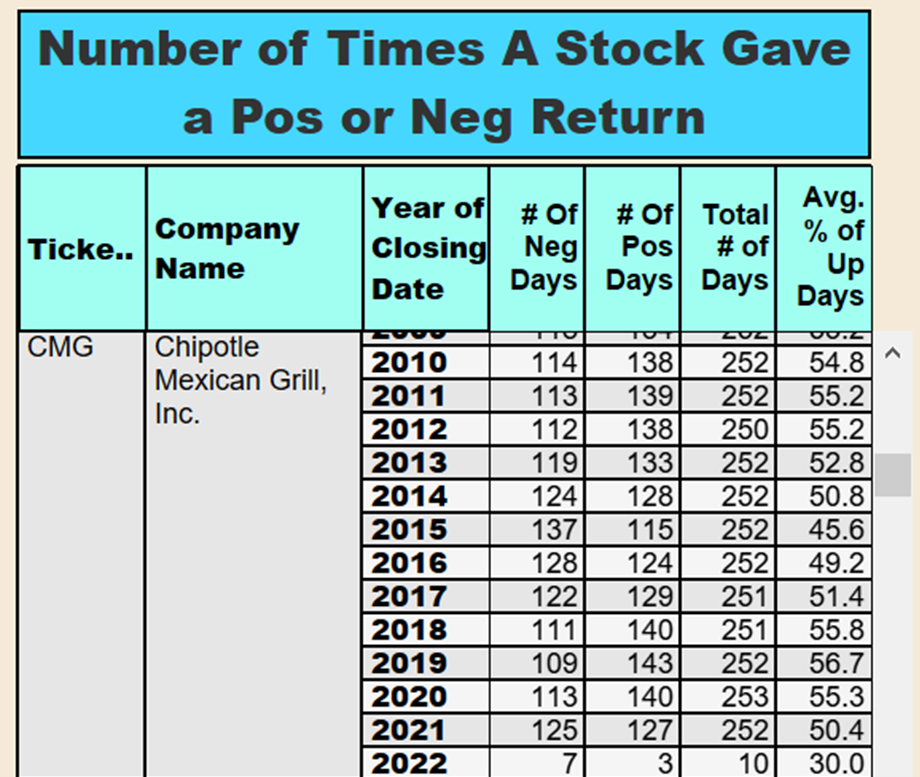

Chipotle has also had only 3 days where it has given a positive return out of a total of 10 days to start the year. Meaning the percentage of positive days is only 30% which is way below its historical averages:

We believe when the market does rebound Chipotle could have a nice bounce back up but its tough to say when this will happen.

As for the other 3 stocks:

– The Nasdaq (NDAQ)

– The Pool Corporation

– Intuit

All of these stocks have historically done very very well. And act more as defensive stocks.

The Nasdaq is the platform/exchange where stocks are traded (bought and sold).

The Pool Corporation makes many products for swimming pools.

Intuit is the maker of QuickBooks and TurboTax.

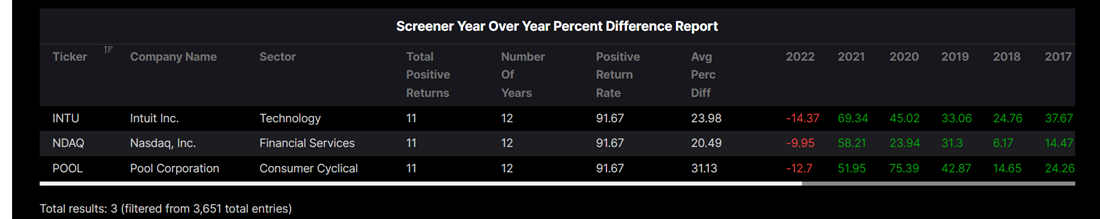

All of these stocks have given a positive return every year over the last 11 years excluding 2022.

This includes year over year returns last year of:

NDAQ: +58.21%

POOL: +51.95%

INTU: +69.34%

These stocks are both high flyers and defensive with great balance sheets. Considering they are all negative year to date we believe these stocks are starting to get cheap.

Intuit is currently down -20.45% from its all time highs putting it right around bear market territory.

Meanwhile POOL is down around – 14.49% from its all time highs. And NDAQ is down around around -11.14% from its all time highs putting these in correction territory.

With all the uncertainty going on in the financial markets right now we expect some short term headwinds but these 3 stocks will be interesting to watch.

Disclaimer:

Risk Disclosure: Trading in financial instruments involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Trading on margin increases the financial risks.

Before deciding to trade stocks you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.